Mississippi residents are most likely to break an iPhone or iPad according to newly published figures.

The figures come from Square Trade, a company that offers extended warranty policies for electronic devices. They take population into account and represent the expected proportion of policyholders making an accidental damage claim over a two year period. The figures come from actual claims made by customers who have had the warrant for at least six months.

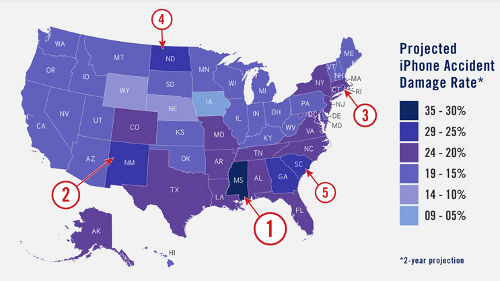

Though the company hasn’t published precise figures, Mississippi is the only state where the expected iPhone butterfinger rate exceeds 30 percent. The next five highest rates come in New Mexico, Rhode Island, North Dakota, South Carolina and Georgia, all falling between 25 and 30 percent.

On the iPad, Mississippi again leads from somewhere in the 30 to 35 percent range, followed by Nebraska (somewhere from 25 to 30 percent), DC (figure not given), New Hampshire and Alaska (20 to 25 percent).

Meanwhile Iowa appears to be home to the most careful owners: it’s the only state with a damage rate below 10 percent for iPhone, while Iowa and Montana are the only states in that range for iPads.

Perhaps inevitably there’s been online discussion (muchof it self-deprecating humor) trying to come up with personal reasons for the variations, the most offensive involving links to obesity rates and suggestions that greasy food leads to slippery fingers.

It is worth remembering though that these aren’t the actual damage rates among all owners, but rather the rate of claims made by policy holders. That could, for example, mean that Mississippi folk are simply more naturally cautious and likely to take out a policy. Another suggestion is that it’s a lower income state where Apple owners feel less able to take the risk of writing off a gadget, particularly given that the cost of repair means owners will often need to buy a replacement.

As with several similar previous SquareTrade surveys, it should be noted that these figures are useful as comparatives but not absolutes. The damage rate may well be higher among warranty holders than the entire population simply because clumsy folk are more likely to consider an insurance policy worthwhile.